- GST

- MCA

- NCLT Services

- Incorporation Of Private Limited Companies

- Incorporation of LLP

- Incorporation of OPC

- Incorporation of Section -8 Company

- Closure of Pvt. Ltd. Companies

- Annual Compliance – Pvt. Ltd

- Annual Compliance – OPC

- Annual Compliance – LLP

- Director Appointment

- Director – Resignation

- Share Transfer

- MOA Amendment

- Registered office Change

- DIN Services

- Others Services

- BUSINESS LICENSES

- Labour Law

- Courses

- Download

- Updates

Call Us +91 8789155395

GST Appeals

Your Trusted Legal & Taxation Partner Since 2012

Introduction

In 21st century business is not just about profit making or loss booking but eventually you need to follows rigorous compliances imposed by different acts or statute around the globe.

India is no exception , there are many regulatory and tax laws which every businesses as per eligibility have to follow otherwise this results in huge monetary punishment in form of penalty and even some cases it leads to confiscation of goods or arrest of the business owners which causes huge damage to their professional reputation.

But all this happen in the last stages, every civilized nation provides reasonable and ample opportunity to the accused person to explain his case and provide evidence in his support.

In India after the implementation of GST in 2017, the act have also provision of numbers of appeal.

Let see

Understanding the Appeal in General

As far as appeal is concerned it can defined literally as

“In law, an appeal is the process in which cases are reviewed by a higher authority, where parties request a formal change to an official decision/orders/judgement. Appeals function both as a process for error correction as well as a process of clarifying and interpreting law”

Every law/act/statute must provide provisions to challenge the order/ decision / judgement of lower authority in the higher authority so that higher authority ensure that the decision making authority have in right manner and direction appreciated the evidences and follows the principles of natural justice.

This is the literal understanding of Appeal in general manner, now understand the reasons of dispute and GST Appeal.

Major Reasons of Dispute –

There are two major components in Tax Ecosystem. Taxpayers means business owners and the Tax takers means government official appointed in tax department.

Both of different view taxpayers on one hand thinks to maximise

The taxes on one hand and on the other hand the Tax takers thinks to optimize the tax collection. So both have a different set of mind and viewpoint due to this tax laws have different interpretation and enforcement for both components till they interpreted by the Supreme Authority.

Understanding the GST Appeal

As we all know that all law imposes obligation on the subject.

Same is with the case of GST Acts, once your register with GST Regime, the acts imposes different obligations in form of compliances.

It also have power to appoint officers to verify to check whether the obligations are fulfilled in right manner or not. This is starting point of dispute.

Many times proper officers appointed by the GST Department makes true observation of the compliance and based upon that order is passed but on many occasion without appreciation correct evidence and based whims and caprice they made order under this act.

The two components have different viewpoints on same order, this results in dispute which is properly resolved as per the GST Laws

The initial resolution of this dispute is done by a departmental officer by a quasi-judicial process resulting into the issue of an initial order known by various names -assessment order, adjudication order, order-in-original, etc. GST Act defines the phrase “adjudicating authority” as any authority competent to pass any order or decision under this Act, but does not include the Board, the First Appellate Authority and the Appellate Tribunal

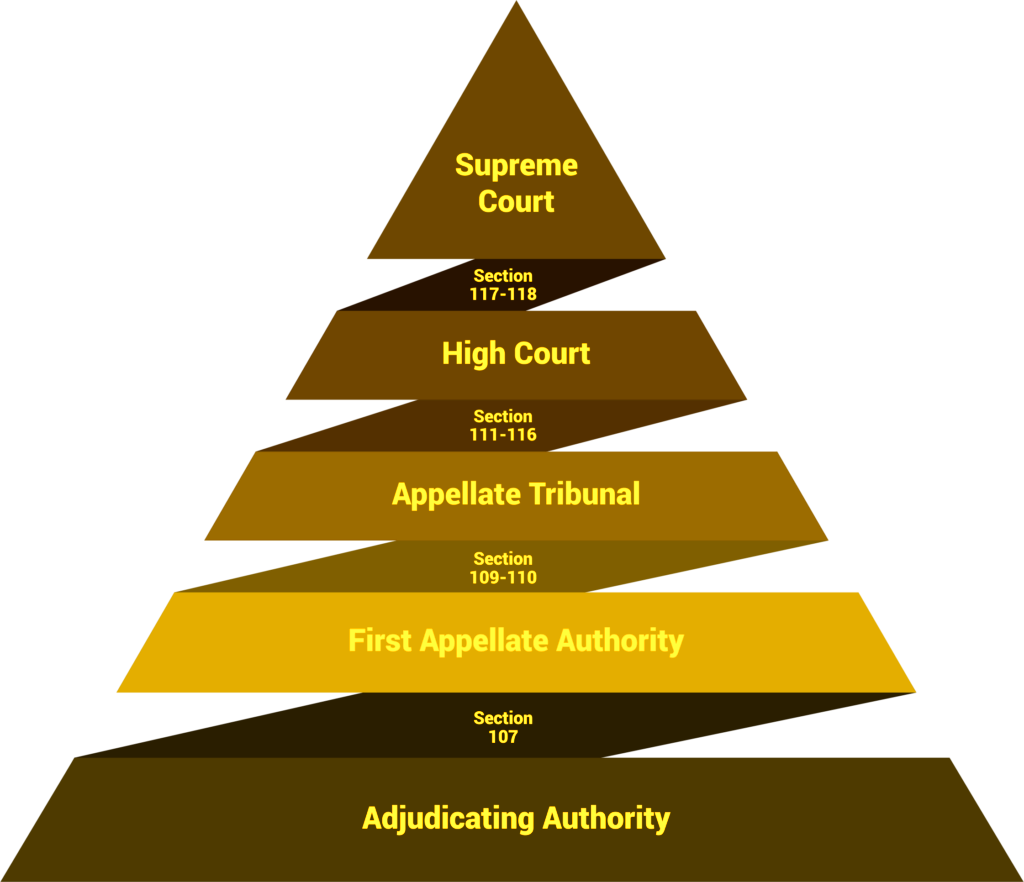

Understanding the hierarchy to file GST Appeals

The GST Acts have clear cut provisions and hierarchy to file GST Appeals.

| Appeal level | Orders passed by…. | Appeal to ——- | Sections of Act |

| 1st | Adjudicating Authority | First Appellate Authority | 107 |

| 2nd | First Appellate Authority | Appellate Tribunal | 109,110 |

| 3rd | Appellate Tribunal | High Court | 111–116 |

| 4th | High Court | Supreme Court | 117–118 |

Let us understand different authorities prescribed under the GST acts.

Who is Adjudicating Authority?

Adjudicating Authority is the authority which passes an order or decision against which we appeal.

Who is First Appellate Authority?

(i) The first appellate authority would be Commissioner (Appeals) where the adjudicating authority is Additional or Joint Commissioner

(ii) The first appellate authority would be Joint Commissioner (Appeals) where the adjudicating authority is Deputy or Assistant Commissioner or Superintendent

Not satisfied with the order of First Appellate Authority?

If the aggrieved person is not satisfied with the order of First Appellate Authority too, then he may go for an appeal before –

(i) National Appellate Tribunal (not constituted)

(ii) High Court

(iii) Supreme Court

Appealable and Non Appealable Order under GST

Appealable Orders –

Following are the orders against which the aggrieved person may file an appeal –

- Enforcement Order

- Assessment or Demand Order

- Registration Order

- Refund Order

- Assessment Non-Demand Order

- LUT Order

Non- appealable orders

An appeal cannot be made against every decision. The following decisions made by a GST officer cannot be appealed:

- Order to transfer the proceedings from one officer to another officer;

- Order to seize or retain books of account and other documents;

- Order sanctioning prosecution under the Act; or

- Order allowing payment of tax and other amounts in instalments

Filling of GST Appeals

Should every appeal be made to both CGST & SGST authorities?

No. As per the GST Act, CGST & SGST/UTGST officers are both empowered to pass orders. As per the Act, an order passed under CGST will also be deemed to apply to SGST. However, if an officer under CGST has passed an order, any appeal/review/ revision/rectification against the order will lie only with the officers of CGST. Similarly, for SGST, for any order passed by the SGST officer the appeal/review/revision/rectification will lie with the proper officer of SGST only.

Appeal to the Appellate Authority

(1) An appeal to the Appellate Authority under sub-section (1) of section 107 of the Act shall be filed in FORM GST APL-01, n[either] electronically [or other wise] as may be notified by the Commissioner, and a provisional acknowledgement shall be issued to the appellant immediately.

(2) The grounds of appeal and the form of verification as contained in FORM GST APL-01 shall be signed in the manner specified in rule Registration.19.

(3) A hard copy of the appeal in FORM GST APL-01 shall be submitted in triplicate to the Appellate Authority and shall be accompanied by a certified copy of the decision or order appealed against along with the supporting documents within seven days of filing of the appeal under sub-rule (1) and a final acknowledgement, indicating appeal number shall be issued thereafter in FORM GST APL-02 by the Appellate Authority or an officer authorized by him in this behalf: Provided that where the hard copy of the appeal and documents are submitted within seven days from the date of filing the FORM GST APL-01, the date of filing of the appeal shall be the date of issue of provisional acknowledgement and where the hard copy of the appeal and documents are submitted after seven days, the date of filing of the appeal shall be the date of submission of documents.

Explanation. – The appeal shall be treated as filed only when the final acknowledgement, indicating the appeal number is issued.

Forms for Appeal in GST

| Si. No. | Purpose | Forms in GST |

| 1 | Appeal to Appellate Authority u/s 107(1) (By Taxpayer) | FORM GST APL-01 |

| 2 | Final Acknowledgement of appeal (with appeal number) | FORM GST APL-02 |

| 3 | Application to Appellate Authority u/s 107(2) (by department) | FORM GST APL-03 |

| 4 | Order of Appellate Authority or Appellate Tribunal | FORM GST APL-04 |

| 5 | Appeal to the Appellate Tribunal (By taxpayer) | FORM GST APL-05 |

| 6 | Memorandum of cross-objections to the Appellate Tribunal | FORM GST APL-06 |

| 7 | Application to the Appellate Tribunal (By department) | FORM GST APL-07 |

| 8 | Appeal to High Court | FORM GST APL-08 |

What is the appeal fee in GST?

- The appeals need to be made in prescribed forms along with the required fees. The fee will be – The full amount of tax, interest, fine, fee and penalty arising from the challenged order, as admitted by the appellant, AND –10% of the disputed amount.

- Fees won’t be charged in cases where an officer or the Commissioner of GST is appealing

1st February 2021

Union Budget 2021: With respect to orders received on detention and seizure of goods and conveyance, 25% of the penalty needs to be paid for making an application of appeals under section 107 of the CGST Act. The date of applicability is yet to be notified.

Conclusion

In conclusion, filing a GST Appeal is a complex process but with an experienced GST Consultant in Patna, it can be simplified. Bihar Tax Consultant has a team of dedicated and trained GST Advocates and Lawyers who can help you get the most out of the GST Appeal process. We provide full consultancy services like GST Registrations, GST Returns Fillings, GST NOTICES reply, and GST Appeals filing. Get in touch with us to explore our comprehensive services and make your GST filing process a breeze.